In this age of cut-throat competition, everybody desires to develop their commercial enterprise past the bounds of the home market. However, doing commercial enterprise globally isn't only a cup of tea for everybody. Before going global, you want to observe numerous processes and legal guidelines in the vicinity and get separate registration and license. Import Export license is undoubtedly considered one among such stipulations while considering uploading or exporting from India. It is likewise called Importer- Exporter Code.

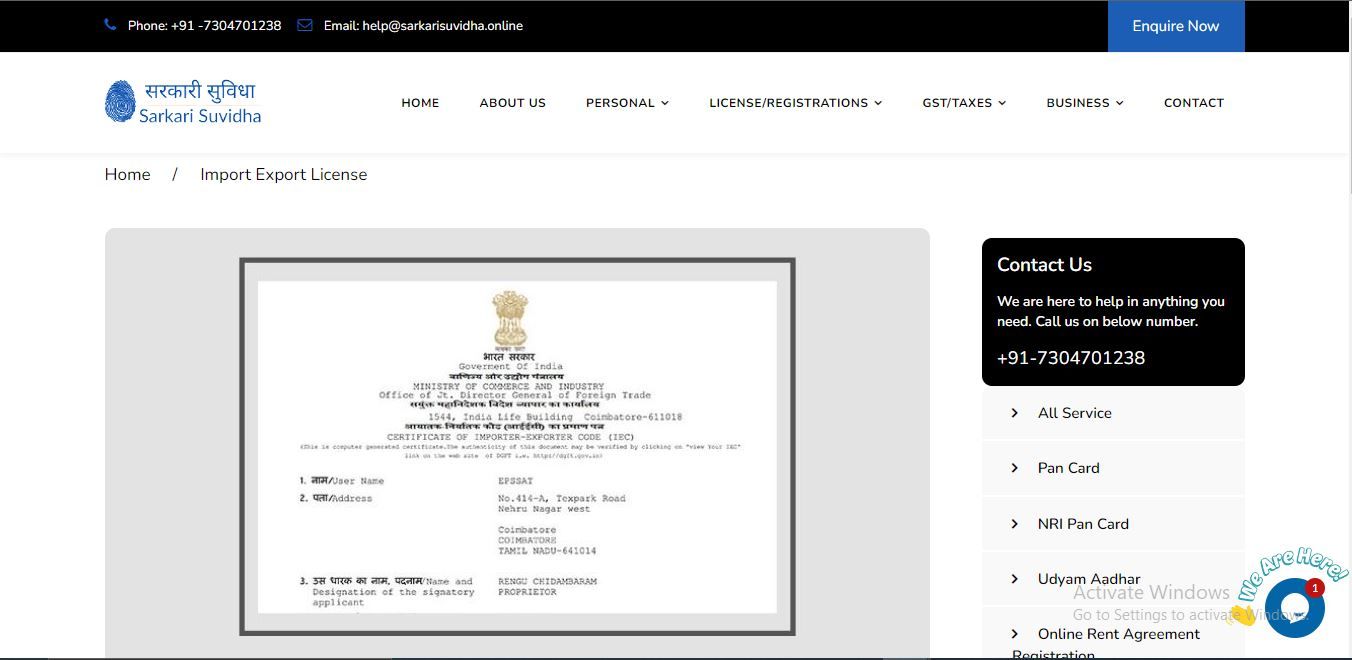

IEC (Import Export Code) is needed for all people seeking to kick-start/her import/export commercial enterprise within the country. It is issued with the help of the DGFT, and IEC is a 10-digit code with lifetime credibility. Predominantly importers traders can't import items without the Import Export Code, and similarly, the exporter service provider can't avail blessings from DGFT for the export scheme, etc., without IEC.

Under What Circumstances are An Import-Export Code Necessary?

- It is compulsory by the customs authorities when the importer has to clear his shipment through customs.

- If an importer sends money abroad via banks, then the bank needs it.

- When an exporter needs to ship their shipments, this is required by the customs port.

- When an exporter receives foreign currency money directly into his bank account, the bank demands it.

Step-wise Online Registration Procedure Of Import Export Code License:

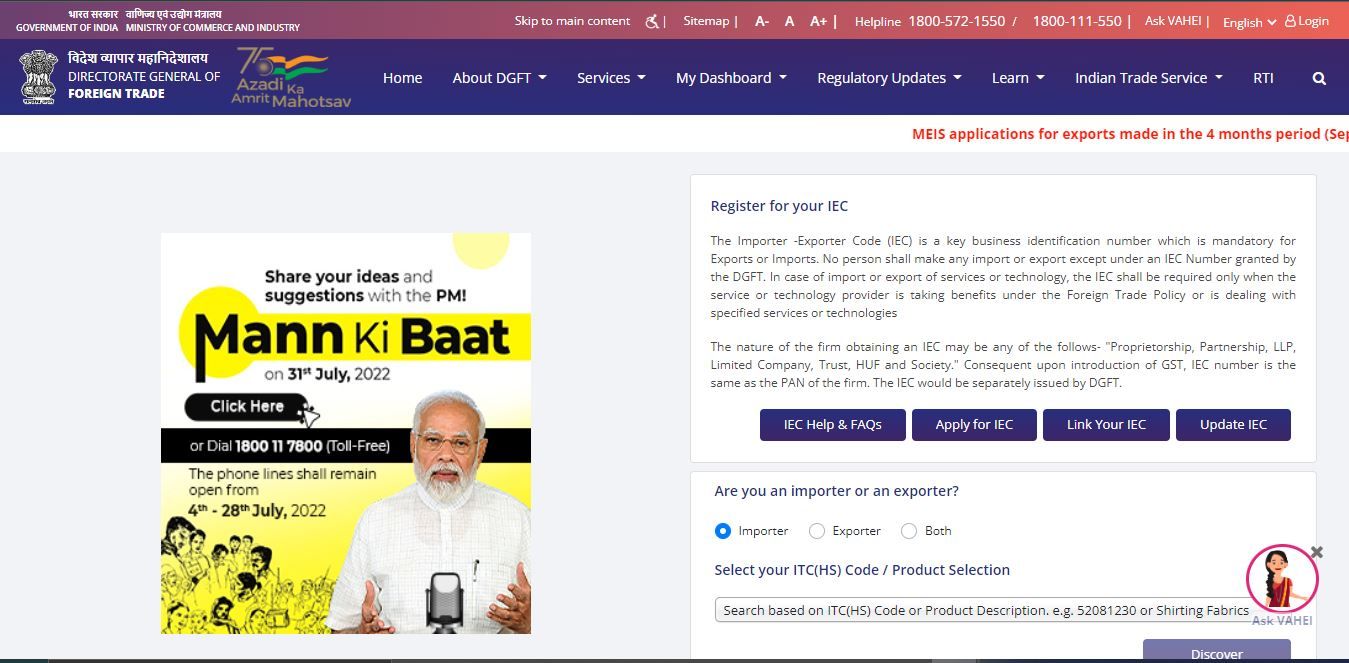

- Visit the DGFT website.

- On the start page, click on the "Services" tab.

- Choose the "IEC Profile Management" option from the drop-down list.

- A new page will open. On the page, click the Request IEC option.

- Click on the "Register" option.

- Fill in the required details and click the Send OTP button.

- Enter the OTP and click the "Register" button.

- After successfully validating the OTP, you will receive a notification with the temporary password, which you can change after logging in to the DGFT website.

- After registering on the DGFT website, log in to the website by entering the username and password.

- On the DGFT website, click on the "Request IEC" option. Fill out the application form ANF 2A, upload the required documents, pay the necessary fees and click on the Submit and generate IEC certificate button.

- Then the DGFT portal generates the IEC code; after that, you can print out your certificate as soon as the IEC code is generated.

Required documents for online import and export code registration:

- Copy of PAN card of person or company or company.

- Copy Individual voter ID or Aadhar card or passport.

- Individuals, companies, or the firm's current bank account copies of the canceled cheque.

- Premise Rent Agreement or Electricity Bill Copy.

- A self-addressed envelope for delivery of the IEC certificate by registered post.

In this overall process, if anyone needs any assistance, then visit our official website of Sarkari Suvidha. Our representative will assist you in the best possible way.

Advantages of IEC Registration:

- IEC helps you bring your service or product to the global market and grow your business.

- Companies can claim various discounts for their imports/exports from the DGFT, the export promotion company, customs, etc., based on its IEC registration.

- IEC requires no declarations. Once issued, there is no need to follow any process to maintain its validity. No obligation to submit statements to the DGFT.

- The IEC code can easily be obtained from the DGFT within 10 to 15 days of applying. It is not compulsory to provide proof of export or Import to get the IEC code.

- A renewal of the IEC code is not required. Valid for a company's lifetime and does not need to be renewed. Once acquired, a company could use it in all export and import transactions.

Cases Where The Import-Export Code (IEC) Is Not Mandator:

As per the latest government circular, IEC is not mandatory for all traders registered under GST. In all these cases, the retailer's PAN is interpreted as the new IEC code for import and export purposes. The Import-Export Code (IEC) is not required if the goods are exported or imported for personal use and not used for commercial purposes. Export/Import is carried out by the Departments and Ministries of the Government of India, and the notified charities are not required to receive an import and export code.